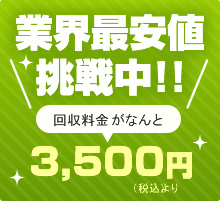

東京都足立区、葛飾区、江戸川区、台東区、墨田区、荒川区の、不用品回収、部屋片付け、遺品整理は便利屋アーカディアへ!

Explain the Nature of a Hire Purchase Contract

A hire purchase contract is a type of financing agreement which is commonly used to purchase goods such as cars, furniture, and other expensive items. This type of contract allows a buyer to pay for the item in regular installments over a period of time, while also allowing them to use the item during the repayment period.

In a hire purchase agreement, the buyer is not the legal owner of the item until the final payment is made. Until then, the seller retains ownership of the item, and the buyer is simply hiring it from the seller. This means that the seller can repossess the item if the buyer fails to make the required payments.

The contract will typically include information such as the total cost of the item, the interest rate, the length of the repayment period, and the amount of the monthly payments. The buyer will also need to pay a deposit, which is usually a percentage of the total cost of the item.

One benefit of a hire purchase agreement is that it can be a more affordable way to purchase an expensive item. Rather than having to pay the full cost upfront, the buyer can spread the payments over a longer period of time. This can make it easier to budget for the purchase and can also free up funds for other expenses.

However, there are also some potential downsides to a hire purchase agreement. The interest rate on the loan may be higher than other types of financing, which can increase the overall cost of the item. Additionally, if the buyer falls behind on payments, they may lose the item and still be responsible for paying the outstanding debt.

Overall, a hire purchase contract is a useful financing option for those who want to purchase an expensive item but cannot afford to pay the full cost upfront. However, it is important to carefully consider the terms of the agreement and ensure that you can make the required payments before entering into the contract.